In United Arab Emirates, Federal Tax Authority (FTA) is main organization to control tax rules. in UAE there are two type of tax:

- VAT (Value Added Tax)

- Excise Tax

Mostly, Excise Tax will be receive on cigarette and Tobacco trading.

How to declare tax in Dubai (UAE)

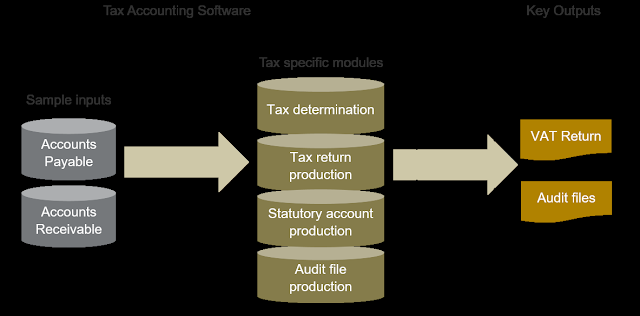

Mainly, there are two way, 1- By an accredited tax auditor 2- By an accounting software

A tax auditor will prepare an official report of accounting transactions in organization format and offer it to FTA of UAE but in Dubai there is an online portal to declare tax and so that, you can export tax audit file from an accounting software and submit this file to e-portal of tax in Dubai.

Therefore, tax accounting software allows for the automation of all tax-based responsibilities, i.e., keeping track of records, payments, file returns, etc., saving businesses time and money. (Text by Tax government in Dubai)Tax report of an accounting software should export:

- FTA audit file

- VAT return fil

- Tax invoices and credit/debit notes

For more info and download iGreen accounting software: www.igreensoftware.com